Who's who in load shifting

The demand response industry is dynamic and growing. This post provides a framework to understand all the key roles, with examples.

11 minute read ∙ Sep 22nd, 2020

In August and September 2020, California's grid faced power shortages and rolling blackouts, putting demand response firmly back in the spotlight as the most cost-effective way to make sure this doesn't happen again. Flexible load can act as emergency capacity (which would have been used in California) and grid balancing (similar to the role a battery can play), and is the most cost effective way to do it. As we have detailed before, the rise of renewable energy is making load flexibility ever more valuable and we expected to grow quickly from the ~$2Bn industry it is today.

While demand response has been around for a long time, the industry is relatively complex and can be confusing. This post helps explain who the key players are and what they do, for the benefit of a relative newcomer (familiar with the basics of the power grid and demand response).

The Framing

The best way to think about the DR industry is first to simplify down to the very basics:

The key players are:

- the load serving entity, which has a need: balance the grid

- the end device / load, which can shift how it uses energy to support that need

The goal is for the grid operator to convey their need, and the load to provide it and be compensated.

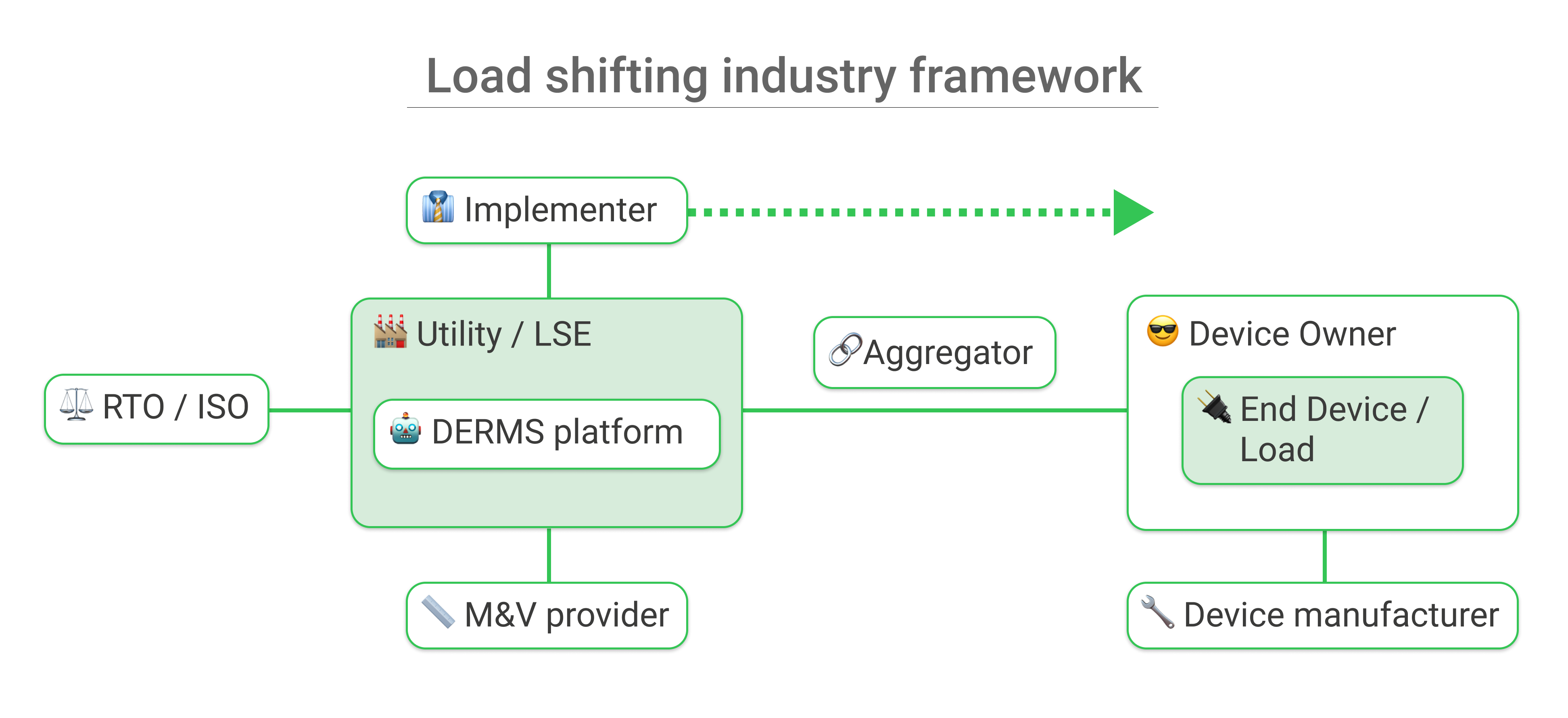

All of the companies in this industry support the two key players to achieve that goal in some way. 9 separate players are shown in this framework and described below.

The Players

🏭 Utility / Load Serving Entity (LSE)

We are grouping together a utility, which owns and and operates distribution power lines, and a Load Serving Entity, which buys power from generators and sells it to end customers. In regulated markets, which are the majority of North America, they are the same entity - IOUs, Munis and Coops generally fit this description. In deregulated markets they are separated - retail energy providers and CCAs are LSEs but do not own grid infrastructure.

They have somewhat different load shifting needs. A load serving entity needs to make sure they can procure enough power to meet demand at any given time throughout their whole region, while distribution utilities are more geographically focused - they need to make sure the grid has enough capacity to deliver power at every point in the grid. Historically they have procured the same type of DR (mass-scale, capacity driven DR) more suited for a LSE, but distribution utilities are starting to also pursue more regional, fine-tuned control such as non-wires alternatives. They are also integrating DR with ADMS (distribution management system software) to better enable this fine control and allow Demand Response to play more of a pivotal role in grid operations.

Despite these slightly different needs, they are close enough so for simplicity we'll group them together.

⚖️ RTO / ISO

An RTO / ISO coordinates and controls regional grids, creating markets to make sure energy and capacity requirements are met on the grid. Approximately half of demand response in the US is bid through an RTO (the rest is bid into utility programs). RTOs usually pay a pivotal role where an LSE is involved and needs to procure energy and capacity for their customers.

The exact need, compensation and implementation mechanisms vary widely. Most common at the RTO level is paying for capacity, which for demand response means the ability to shed a certain amount of load when requested - the carrot approach. PJM capacity markets are an example of this. Energy markets are also available for Demand Response to participate in, thanks to FERC 745, but so far this is relatively nascant. The alternative to markets is the stick: using price signals such as coincident peak pricing, which encourage shedding load by making it very expensive to use energy during the peak. ERCOT uses this approach with it's coincident peak charges and real time rates.

RTOs operate at a huge scale and usually only want to deal with large loads (or small loads aggregated together into large loads), and are very hands off - they provide a market and let companies bid in capacity if they are able to (or passively shift if using pricing mechanisms). By contrast, utility programs are often more hands-on, e.g. paying individuals to access their devices or directly installing controls on-site.

With these distinctions made, we'll group utilities and LSEs together and refer to them as LSEs, for simplicity.

🔌 End device / load

Eventually we get down to the actual load being shifted. Even here there is some nuance, e.g. with Air Conditioning loads, the "device" could be either the thermostat that determines when the unit runs or the actual A/C unit (or even, because I know you want to be pedantic, the fans / compressors / etc inside the A/C unit that are consuming the power). So let's be explicit and define the devices / loads as the system that is being interacted with, for example:

- Thermostats, for both heating and cooling

- On / off switches for A/C window units and water heaters

- Water heater control panels (built in, or added on)

- Smart plugs

- Energy storage / battery control systems and smart inverters

- EVSE (electric vehicle supply equipment)

- Smart panels (e.g. Span.io)

As we get into commercial and industrial loads, it gets harder to define exactly what the loads are because the equipment becomes more customized and layers of control get deeper. Some examples are:

- Building energy management systems that control many types of load in a building, facility or site

- Industrial loads (e.g. an agricultural pump commissioned as a grid resource, as Polaris facilitates)

- Commercial lighting controls systems

- Microgrid controls software, providing a single point of reference for multiple resources in a site (e.g. CleanSpark)

😎 Device Owner

Whether it's a residential homeowner or an energy manager at a large scale facility, someone actually owns and operates the load, making that person the most important player - don't forget it! The key to scalable and effective programs is considering the device owner: do they understand what you are trying to do? Why would they let you control their load? Why should they care what the utility needs? For a successful program, answer those honestly and with the an understanding of typical customers, not ideal customers.

Historically, the device owner was primarily a facility manager who was called, emailed or texted to ask them to manually turn loads, so they were highly involved in the process. As we move to automate load shifting, device owners won't be required to take manual action, which is great for them! They will still need to be motivated and compensated to sign up, and kept informed and comfortable as load shifting events get executed.

🔧 Device manufacturer (OEM)

OEMs build, sell and maintain the devices, and, for smart devices, offer a software controls platform for their users. There are a few different roles an OEM can play in demand response:

No role

At the most limited end of the spectrum, OEMs just build and sell the devices, leaving them to be commissioned by a third party to participate in demand response. For example, most water heaters sold are "dumb" water heaters, which are then retrofitted with a device to provide the controls and connect the water heater to a load shifting program, such as by Shifted Energy's Tempo device.

On the plus side, device manufacturers can continue business as usual and don't have to worry about demand response. On the negative, this means that device manufacturers are sidelined from load shifting programs and their subsequent revenue opportunities, and their devices will not be used as they fully intended. It puts them on the defensive.

Facilitator

To facilitate, OEMs build capabilities into their device or platform that allows them to participate in load shifting programs. For example, they could build a demand response capability, add OpenADR and allow third parties to get the device owners permission and control the devices in DR programs.

Adding these capabilities allows a device to qualify for utility rebates, making the utility sales channel a valuable one. This will lead to more sales of hardware products.

Even better, OEMs that maintain control over the end device can charge a fee per connected device in exchange for the valuable service they provide. This can be charged to the customer (more common in C&I) or to the utility or aggregator that is administering the program (more common for residential loads). This provides a rare opportunity for a high margin, repeatable revenue source for hardware companies. It also allows them to ensure the device is only operated in a way that keeps their customers comfortable, avoiding potential bad customer experiences.

Active participant

At the most involved end of the spectrum, OEMs can enter into agreements with load serving entities and put together demand response programs with utilities or bid them directly into RTO programs. The best example of this is Nest's Rush Hour Rewards programs, which is implemented with many different utilities.

In this model, the OEM skips the middle-man and acts as more of an aggregator themselves. This will not be a good fit for most OEMs, because it takes them out of their core competency and exposes them to the complexities of the energy markets. Most OEMs will have more luck playing a facilitator role and working with a 3rd party such as an Aggregator or DERMS provider to monetize their DR capability.

🔗 Aggregator

Aggregators are third parties that do what the name suggests - they aggregate load. For example, they can sign up many smaller loads and aggregate them together, abstracting the underlying complexities away and offering load serving entities a simplified, larger load to control.

Aggregators come in all shapes and sizes and specialize in different sectors. As a few examples, OhmConnect aggregates residential load and EnelX (formerly EnerNOC) and Voltus aggregate commercial and industrial loads, both operating in RTO markets, while Packetized Energy works with all types of load and usually works with utilities.

An aggregator solves two key issues:

- End customers are not savvy about the energy business and need help understanding it

- Utilities are great at working with power grid technology, but not so strong in the messy world of the consumer economy.

Aggregators bridge the gap, reducing friction and improving program outcomes. They should be considered as an important keystone species in this ecosystem, but are, unfortunately, often avoided in utility programs when utilities would rather interfacing with end customers directly. Successful, scalable programs will allow a role for aggregators to compete on their merits.

Retail Energy Providers (REPs) such as Arcadia could also be considered a type of aggregator, if they choose to become one. They have access to end loads and can bid those into ISOs or utility programs, or shift it to save themselves energy procurement costs. REPs have an enormous, mostly unrealized potential as load shifting facilitators because they already have a customer relationship and economic incentive to shift load. Load shifting is more accessible as smart devices proliferate and REPs are well placed to take advantage - this could be a major source of load shifting as this sleeping giant awakes.

👔 Program Implementers

Program implementers are consulting firms that support utilities to create and administer projects, including demand response programs. They do program design, sign up customers, manage outreach, etc. These are typically regional consulting firms that specialize around a state or local utility, but some companies (e.g. CLEAResult, ICF, Franklin Energy) have bought up a lot of regional firms to create a more national presence. The line between aggregator and program implementer can easily blur, since aggregators sometimes play the role of a program implementer for specific programs at regulated utilities. In general, implementers will work closely with regulated utilities, whereas aggregators work more often in RTO markets.

🤖 DERMS platform providers

These companies provide the software solutions for utilities to manage the programs. These tools are primarily built for utilties, but are increasingly being taken up by aggregators as the complexity of their task increases. The exact term for the software provided can vary by technicalities (DERMS, DRMS, VPP software), but the general role of these software solutions is to provide the tooling to administer load flexibility from all sources. Functionality includes:

- Register loads

- Predict / forecast grid needs

- Create load shifting events and control logic

- Communication to device owners and aggregators

- Measure participation and dispense compensation

A couple of examples in this category are the established leader Enbala and the up and coming Camus Energy (which is also working on distribution management).

Similar to Implementer, the lines between aggregator and DERMS platform provider can also easily blur, especially for software-savvy companies such as Packetized Energy that can play both roles. The distinction made here is that DERMS companies are software solution providers vs aggregators who do more of the hands-on work to register and work with end customers - some companies do both!

📏 Measurement & Verification providers

Because demand response is the absence of consumption, you can't directly measure how much has been produced. Instead, it must be estimated using statistical analysis. This is the job of an M&V provider: they are an impartial 3rd party that is responsible for determining how much load has actually been shifted. There are a few different approaches taken:

- A simple algorithm chosen to produce a baseline (e.g. average of last 10 days) - common in RTO programs

- A consulting firm such as Cadmus, which provides a more custom analysis - common in utility programs

- A sophisticated measurement platform to monitor programs at a more fine-tuned level, a model introduced to utility programs by Recurve. This capability provides the ability to fully value load shifting resources alongside generation resources, and represents a very promising development for load shifting.

Summary

Everything about this market will vary from region to region and adapt over time, but this overall framework should continue to apply. This should help newcomers find their role, understand who the other companies are, and get involved! If you have any questions or comments, please reach out to us at contact@gridfabric.io.

Interested in learning more?

Sign up for our quarterly(ish) newsletter with industry & protocol news, commentary and product updates.

Or if you'd like to discuss, contact us